Health Insurance For Dependents Of Medicare Recipients

1 If you receive Form 1095-B You should have it by mid-March. The Medicare beneficiarys benefits generally dont.

Medicare however covers beneficiaries only on an individual basis.

Health insurance for dependents of medicare recipients. The COBRA law allows people who have left or lost a job to continue coverage through their former employer for up to 18 months by paying the full premiums. In most situations Medicare beneficiaries must be either a US. CHAMPVA is a health insurance option for certain dependents of veterans.

If your dependents have lost coverage from your employee health insurance due to your transition to Medicare they may be eligible for this temporary form of insurance. Health insurance helps you pay for many types of medical expenses. In this case if the working spouse is still working the non-working spouse should stay on the work health insurance and just take Part A as Part A is premium free for most people.

If eligible spouses and dependent children can receive this coverage even if departing employees dont take it themselves. If youre getting health coverage from an employer through the SHOP Marketplace based on your or your spouses current job Medicare Secondary Payer rules apply. If the working spouse is no longer employed the non-working spouse should go ahead and apply for coverage fully from Medicare.

You dont have to pay a premium for CHAMPVA coverage. Coverage from an employer through the SHOP Marketplace is treated the same as coverage from any job-based health plan. Unlike other types of insurance Medicare is not offered to your family or dependents once you enroll.

There are a variety of private health insurance companies with plans that can cover anyone in your household who is not eligible for Medicare benefits. Once you earn over 90000 the surcharge amount depends on your income tier. Citizen or a legal permanent resident of at least five years in a row.

Most people qualify for Medicare benefits because of their age but some qualify because of a long-term disability. Each plan option includes a prescription drug benefit. The Medicare Levy Surcharge is designed to encourage people to take out health insurance and where possible to use the private hospital system to reduce the demand on the public Medicare system.

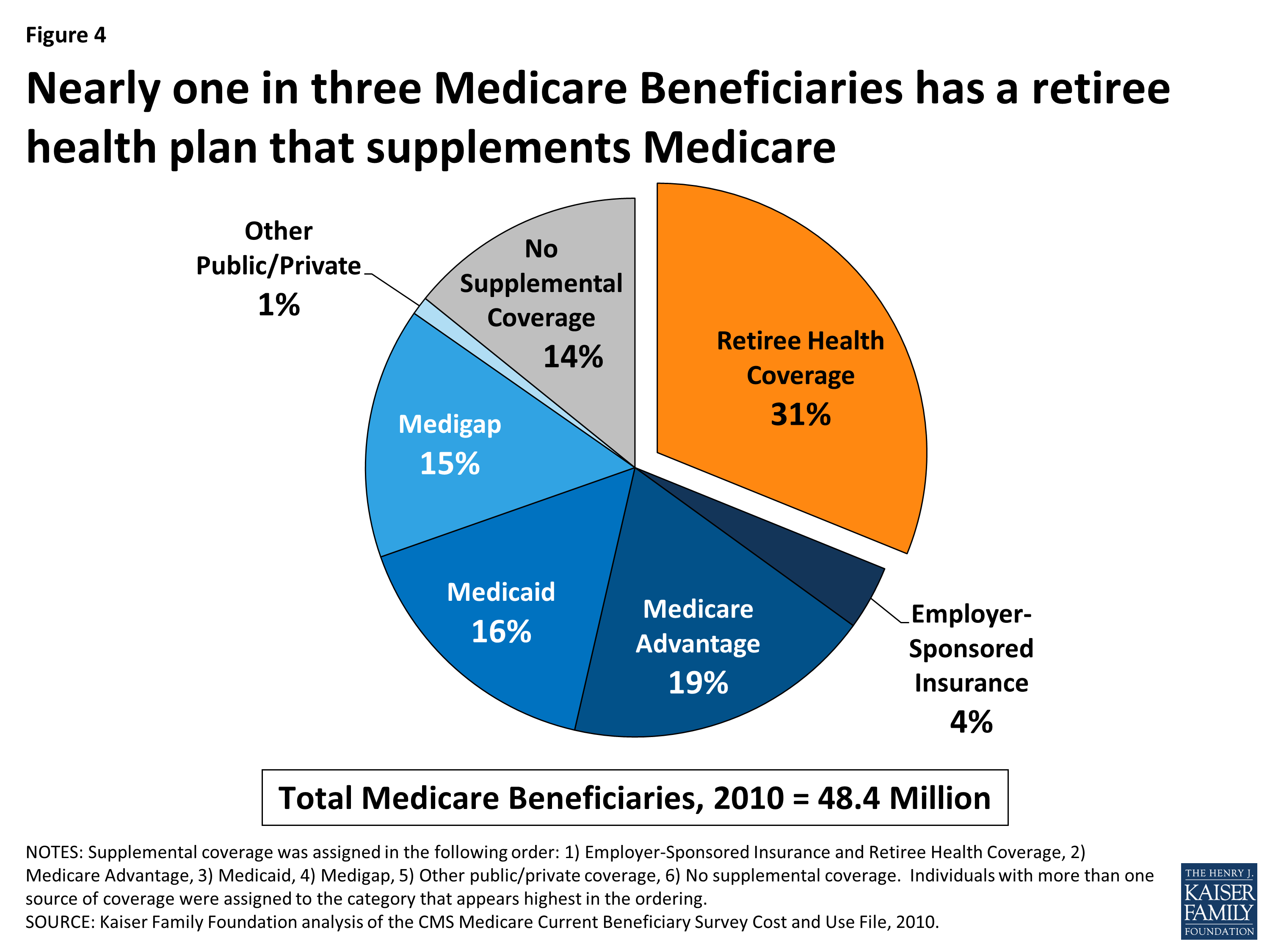

Baker says for example young adults up to age 26 who were covered under their parents insurance are no longer covered when their parent moves to Medicare. If you had coverage through Medicare Medicaid the Childrens Health Insurance Program CHIP or another source depending on the coverage you had you may get Form 1095-B Health Coverage to help you complete your taxes. When a spouse or parent signs up for Medicare it is often perplexing and unnerving for the rest of the family who may have grown used to cushy employer-sponsored coverage.

To get Medicare each person must qualify on their own. Learn more about how Medicare works with other insurance. As a result some retirees may decide the premium to cover a spouse not yet eligible for Medicare is more than they can comfortably afford.

Medicare doesnt cover dependents says Baker. You can use CHAMPVA. Include the non-Medicare-eligible retiree benefits on one side and the Medicare-eligible retiree benefits on the other.

Joe Baker is president of the Medicare Rights Center a patient education group with a busy hotline for those with Medicare questions. As just about everyone understands except you Medicare doesnt cover dependents--its individual coverage for people 65 and over some liimited exceptions to the age requirement exist Im. However if youre a dependent of someone who is losing coverage because theyre retiring.

Dependents can be children of the policyholder spouses and other qualifying family members Dependents receive coverage from the policyholder Dependents that are adult children can stay on their parents plans until the age of 26 The precise definition of a dependent as it relates to health insurance. If you have a job that offers you health insurance benefits but youve chosen to waive that health insurance in favor of being covered under your spouses plan youll be eligible for a special enrollment period at your workplace when you lose access to the insurance plan your spouse had pre-Medicare. If youre familiar with employer-sponsored health-care plans you may expect your whole family to be covered under one health insurance plan.

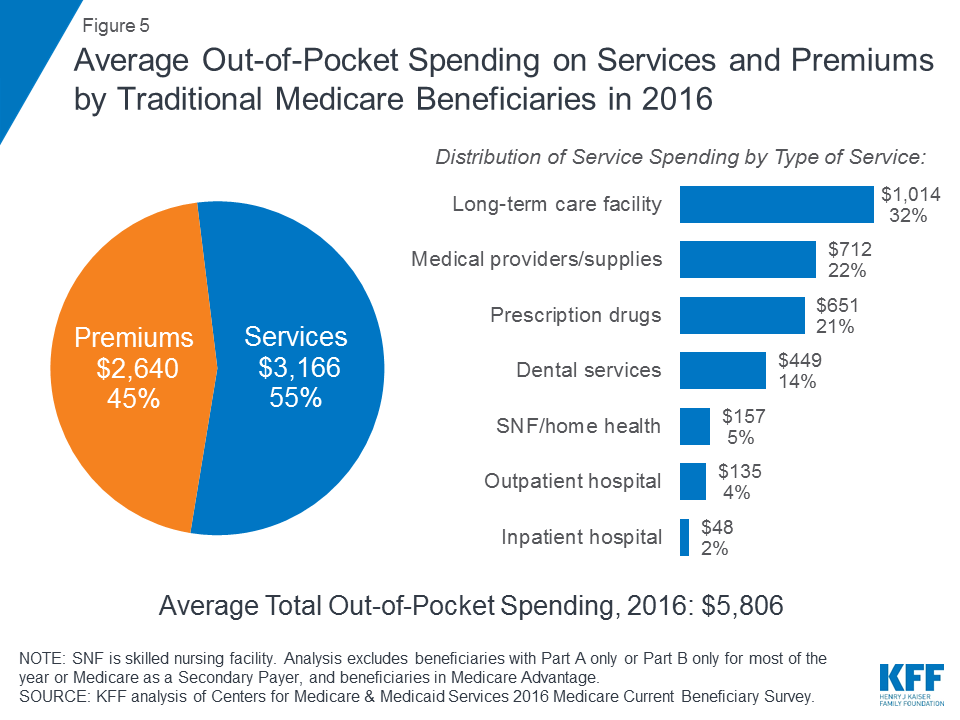

Eligible retirees andor their dependents who are not eligible for Medicare will have the choice of two health plans through BlueCross BlueShield of Nebraska. According to 2016 research Medicare is associated with lower spending on healthcare services compared with private insurance. Eligible spouses under age 65 are eligible to enroll in the OPERS Retiree Health Plan administered by Medical Mutual and are responsible for the full cost of OPERS health care coverage.

Children who do not meet Medicaids. COBRA temporary insurance.

Retiree Health Benefits At The Crossroads Overview Of Health Benefits For Pre 65 And Medicare Eligible Retirees 8576 Kff