Dual Health Insurance Coverage Rules

Under the Affordable Care Act parents are permitted to keep their children on their existing health insurance policy until their 26th birthday regardless of whether or not they have their own insurance. Whereas a re-insurance is made by a former insurer his executors or assigns to protect himself and his estate from a risk to which they.

When Can I Buy Individual Health Insurance

Most health insurance will only cover the amount that is reasonable or customary which would mean the health insurance provider will not pay for any services or supplies that are being billed at a cost that is more than what is the usual charge for the.

Dual health insurance coverage rules. Subject to federal and state laws Coordination of Benefits COB has a specific sequence in which payers reimburse claims for patients who have dual insurance coverage. Both insurers follow rules for coordination of benefits to determine who the primary insurer is. If your primary insurer agrees to pay just 60 percent of the cost of a surgical procedure or preventive examination your secondary policy will probably step in and pay the remaining 40 percent.

Dual insurance helps people maximize their benefits. The primary insurer is responsible for paying claims first. When you carry double coverage your primary health insurance coverage is supplemented by your spouses plan.

It differs from re-insurance in this that it is made by the insured with a view of receiving a double satisfaction in case of loss. The fact that your husbands employer offered you coverage prior to you having another option is them actually going above the requirements of the Employer Mandate but there is also no rule in the Affordable Care Act that requires them to drop you from your husbands plan just because you now have an employer offering you coverage. For full dual eligible beneficiaries Medicaid will cover the cost of care of services that Medicare does not cover or only partially covers.

Double insurance is when you have two different health insurance plans. Fortunately obtaining dual coverage on your insurance plan is one way to cut medical costs. If a child was to become employed and he or she was provided health insurance by the employer dual medical coverage would result.

How Dual Coverage Insurance Works. Even if a patient has more than one health insurance plan the health insurance companies still follow the same rules in how they pay for services. If one spouse has a good health insurance policy covering dependents through their company our advice would be for the other spouse to save the money he or she is paying for dependent coverage.

Additional billing requirements for dually eligible beneficiaries Resources. INSURANCE-HEALTH INSURANCE-INSURANCE COMMISSIONER-Coordination of benefits in cases of dual insurance coverage 1. Did not have coverage for any month of the year.

The benefits of double insurance is that you have two health plans that can help pay for care. A child may have dual coverage if he is covered under both of his parents plans. In a dual coverage situation the primary insurer will pay out benefits first.

The downside is that you have to pay two premiums and two deductibles. As a result any health care services that a dual eligible beneficiary receives are paid first by Medicare and then by Medicaid. Just have to check the full-year coverage box on your Form 1040 series return and do not have to read any further.

Were eligible for an exemption from coverage for a month. If a child breaks his arm only one insurance company may pay. You can get dual coverage by obtaining health insurance from both your and your spouses employers.

This may happen if you have coverage through your job and your spouses plan. RCW 4821200 as amended does not require a secondary insurer to pay the full policy amount to an insured who has dual or multiple coverage whether the policies in question are individual or group policies. This plan becomes known as your secondary health insurance policy.

Having multiple health insurance policies may mean extra help with medical costs since dual coverage lets people access two plans to cover healthcare costs. However if you have to pay a premium for dual coverage insurance coverage from one or both employers the premium cost may exceed any benefits youd receive through coordination of benefits. When a patient has dual coverage plans will coordinate the benefits to avoid over-insurance or duplication of benefits.

Additionally if you have coverage through your parents plan or your partners plan you dont have to worry about going uninsured if you lose your job and the health insurance that comes with it. Should check the instructions to Form 8965 Health Coverage Exemptions to see if you are eligible for an exemption. For example if you have to pay 2500 a year for an extra 4000 in coverage youd be better off putting the 2500 in your emergency fund.

Where the insured makes two insurances on the same risk and the same interest. It is wise to check with both plans. When someone has health insurance coverage under two different policies one is the primary insurance policy and the other is secondary.

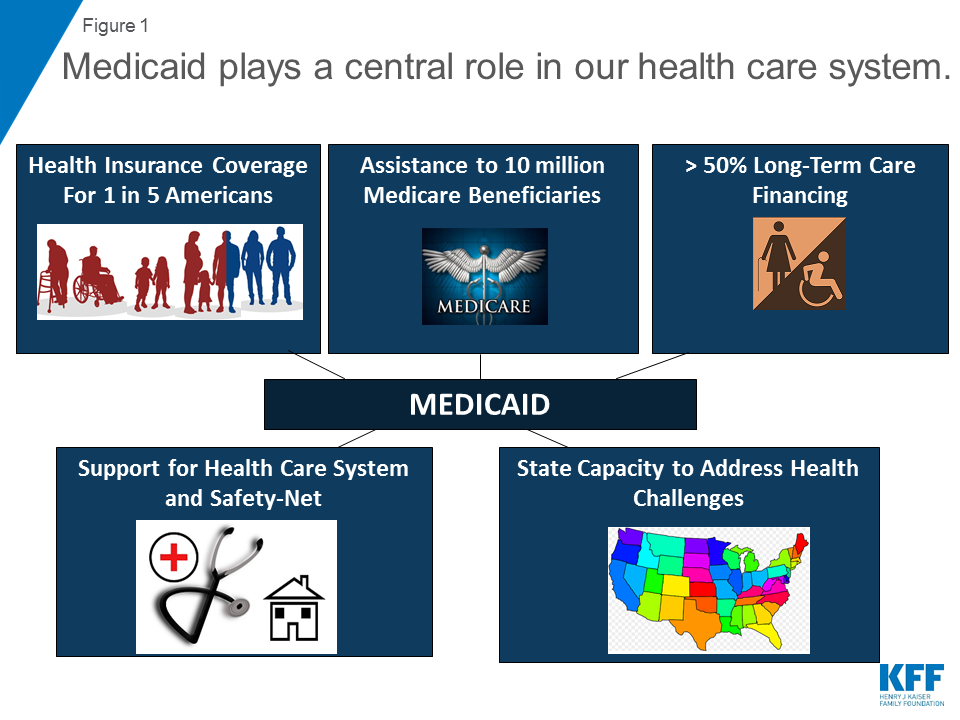

However those benefits may not and usually will not cover all out-of-pocket expenses for a particular procedure treatment or hospitalization. MEDICARE AND MEDICAID PROGRAMS Medicare Program Medicare is health insurance for people 65 or older certain people under 65 with disabilities and people of any age with End-Stage Renal Disease.

10 Things To Know About Medicaid Setting The Facts Straight Kff

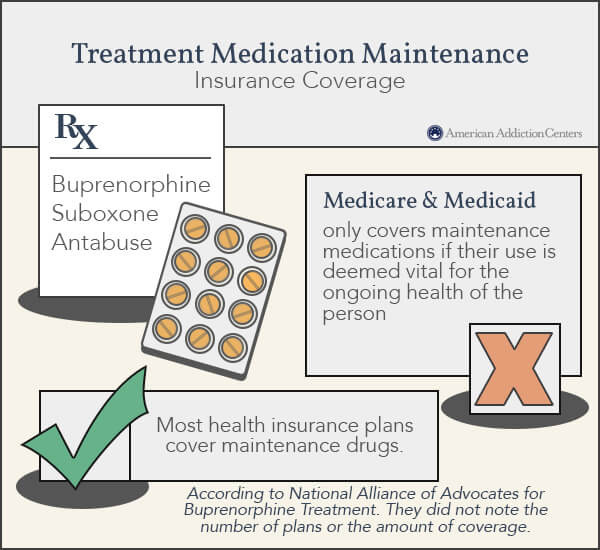

Rehab Insurance Health Insurance Coverage For Alcohol Or Drug Addiction Treatment

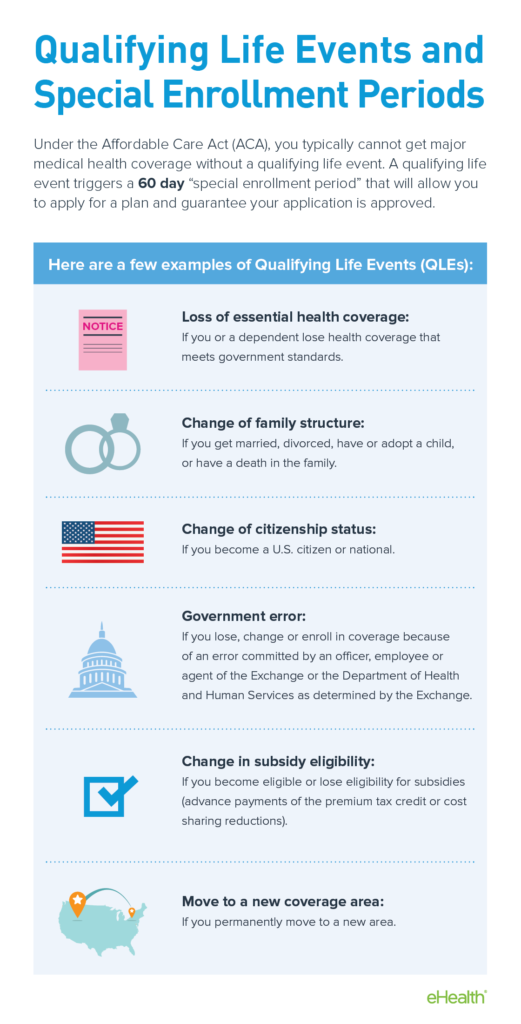

Health Insurance And Pregnancy 101 Ehealth Insurance

Health Insurance And Pregnancy 101 Ehealth Insurance