Short Term Health Insurance Hsa Eligible

For a health insurance plan to be considered HSA eligible it must have a high deductible Self-only. Lets discuss how you can use your HSA right now.

Short term health insurance underwritten by Golden Rule Insurance Company is a flexible health insurance coverage solution when you need coverage for a period of transition in your life.

Short term health insurance hsa eligible. In order to take advantage of these opportunities however you must be eligible to set up a health savings account. HSAs are also good for the short term. To be eligible to make HSA contributions you must be covered under an HSA-qualified consumer-driven health plan CDHP on the first day of that month.

Short-term health insurance plans have been in the news quite a bit for the last few years. In order to qualify the annual individual deductible of a temporary health insurance family must amount to or exceed 1100. Short Term Insurance Short term health insurance is temporary insurance designed to fill gaps in coverage.

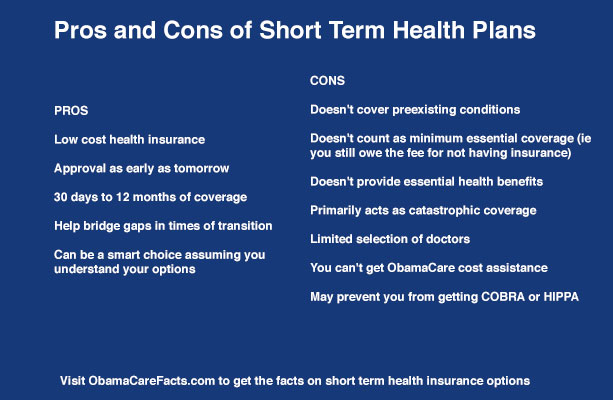

You can be denied or charged more for any reason. Short-term health insurance STM plans are meant to be used when you have a temporary insurance coverage gap. Premiums are much less expensive than comparable plans and are a great option while you look for a job.

Medicare and other health care coverage if you were 65 or older other than premiums for a Medicare supplemental policy such as Medigap That leaves most people going back to the market place for coverage. Their short-term and long-term savings options create flexibility to enable the specific HSA strategy that works best for you. You can find your term plans at eHealthInsurance.

In theory you can pay for any health insurance premium using HSA funds but you must be unemployed. Pre-existing conditions wont be covered. The value and benefits of an HSA are hard to pass up.

Plans require medical underwriting. Qualified medical expenses like dental and optometry expenses big purchases like Lasik eye surgery and teeth straightening and smaller medical needs like eyeglasses are all HSA-eligible. Bridge the gaps in health insurance coverage.

The Affordable Care Acts open enrollment period OEP from November 1 through December 15 in most states is your chance to secure. See our list of Qualified HSA Expenses or refer to IRS Form 502 for more information. Here are the requirements to determine your HSA eligibility.

You can ONLY use your HSA to pay health insurance premiums if you are collecting Federal or State unemployment benefits or you have COBRA continuation coverage through a former employer. When you compare plans on HealthCaregov HSA-eligible HDHPs are identified on plan cards by an HSA-eligible flag in the upper left-hand corner. If your health situation changes its possible you wont qualify.

In addition to allowing an eligible individual the ability to deduct contributions made to hisher Health Savings Account HSA distributions are tax free when. You can also filter to see only HSA-eligible plans by using the Filter option in the right-hand corner and selecting the Health Savings Account HSA Eligible Plans filter. Short term health insurance is a type of health plan that can provide you with temporary medical coverage when you are between health plans outside enrollment periods and need some coverage in case of an emergency.

The minimum deductible must be no less than 1350 for individual plans and 2700 for. Out-of-pocket expenses per individual cannot are limited at 5500 per year under a HSA health plan. Meet the IRS minimum annual deductible for 2021 this is 1400 for self-only coverage and 2800 for family coverage.

The Obama Administration issued regulations in 2016 limiting short-term plans to three months and prohibiting renewals. An HSA-eligible consumer-driven health plan must. Typically this insurance lasts for 6 months but may last up to a year.

Short term health insurance. Used to pay for or reimburse an HSA owner for qualified medical expenses incurred by himher hisher spouse or hisher tax dependents and. Perhaps you lost a job are no longer eligible for a group insurance plan find the.

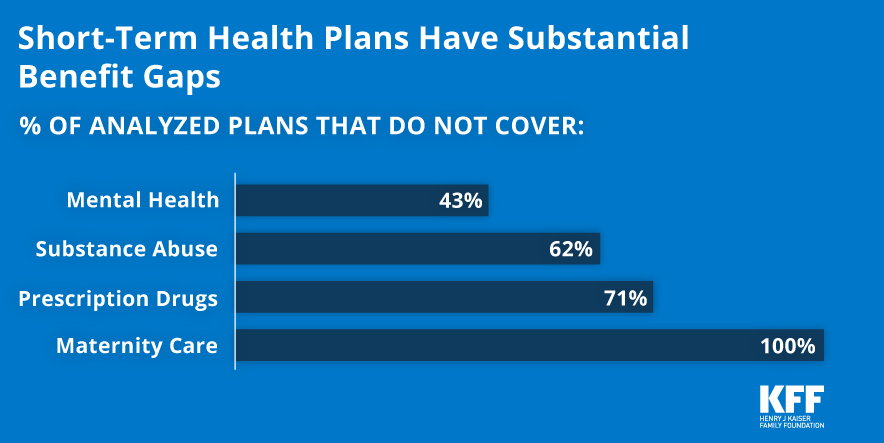

2600 for 2017 a limited Out-of-Pocket Maximum 7150 for an individual and 14300 for a family for 2017 AND it must not cover any additional benefits besides Preventative Care before the deductible is met. Then in 2018 the Trump Administration issued new regulations allowing short-term plans to have initial terms of up to 364 days and to be renewable if the insurer. Short-term health plans have a lot of limitations.

Short Term Health Insurance provides benefits in the same way a major medical plan does but for a predetermined length of time. If you enroll in a high-deductible health plan HDHP youll be eligible to fund an HSA. For a health plan to be HSA-qualified it must meet the following criteria for 2018.

Temporary HSAs are typically partnered with a high deductible short term health insurance plan. Thats one of the biggest downsides of short-term health plans -- they dont have to cover pre-existing conditions. You can use HSA funds for medical costs you have right now.

Short Term Health Insurance Vs High Deductible Health Plans

Compound It The Truth About Short Term Health Plans

Short Term Health Insurance Vs Obamacare

Understanding Short Term Limited Duration Health Insurance Kff