Rhode Island Health Insurance Penalty

Ad 247 Helpline Experts Speak Over 145 Languages. 2019 Rhode Island residents are required to maintain health insurance known as Minimum Essential Coverage or be subject to a tax known as the Shared Responsibility Payment Penalty.

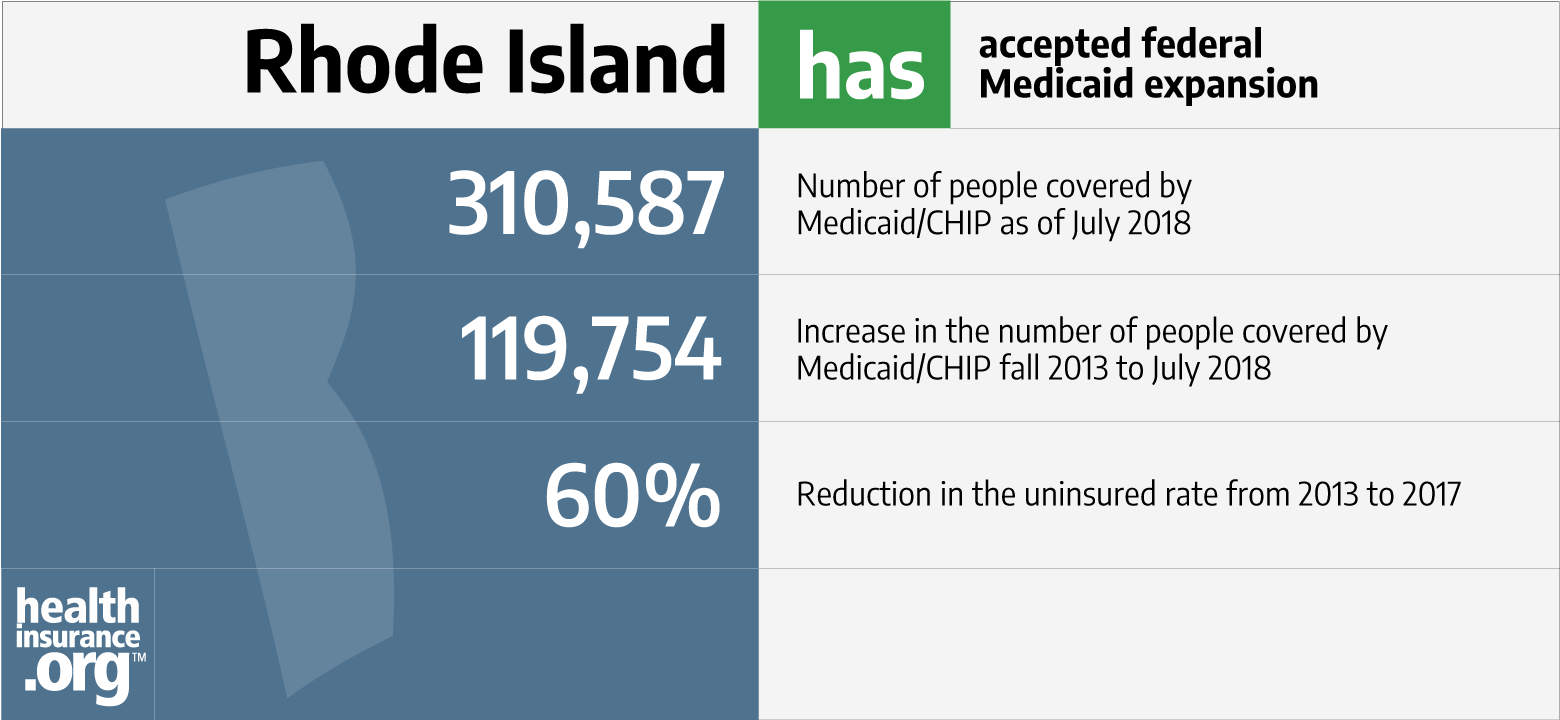

Rhode Island And The Aca S Medicaid Expansion Healthinsurance Org

Rhode Islands individual mandate penalty amounts are modeled after the penalty amounts that applied under the federal individual mandate penalty in 2018.

Rhode island health insurance penalty. Sign up today to avoid a tax penalty later. The states taxation division released a list of tax changes taking effect Wednesday including the new health insurance mandate. Connect With Doctors Hospital.

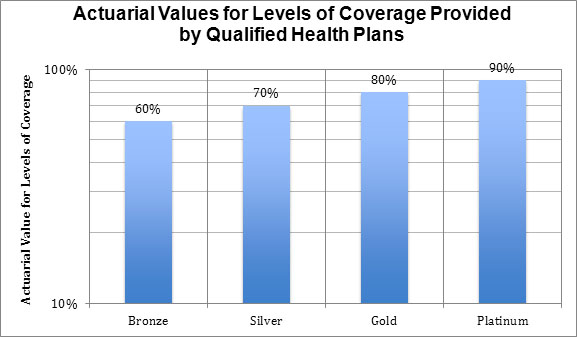

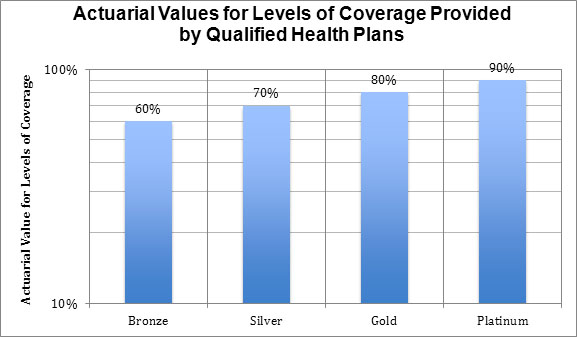

Its free to compare and you wont need to provide any personal information to get started. Even if the 25 of household income produces a higher number the maximum penalty can be no more than the cost of the total annual premium for an average bronze plan sold through HealthSource RI. Rhode Islands individual mandate penalty is calculated in the same manner as the ACAs individual mandate.

Ad You can compare over 600 health policies from over 20 different funds online now. Its free to compare and you wont need to provide any personal information to get started. Even if the 25 of household income produces a higher.

The dollar amounts increase annually with inflation. Without coverage Rhode Island residents will pay a fine unless they are exempt. The penalty for not having minimum essential coverage mirrors the IRC Section 5000A excise tax before its amendment by the TCJA.

Residents who do not have minimum essential coverage in 2020 and do not qualify for an. As of January 2020 Rhode Island has implemented their individual mandate program that is modeled after the federal individual mandate. For more information please see the table below.

The Rhode Island Division of Taxation recently released guidance on their state individual mandate reporting requirements. Theres more than one way to get help signing up for health coverage. This is an important tool in keeping Rhode Islanders covered and maintaining their access to.

The greater of 695 per uninsured adult half the amount for a child up to a maximum of 2085 per family or 25 percent of income. There is a maximum fine of 2085 per family or the average cost of a bronze plan in Rhode Island. AP Rhode Island residents must now have health insurance or face a penalty on their taxes.

A health plan purchased in the individual market. The same requirements and penalties from the federal mandate are applied to Rhode Islands new individual mandate system. Health insurance is required in Rhode Island.

Ad Health Insurance Plans Designed for Expats Living Working in Myanmar. As a reminder the Rhode Island individual mandate RI Mandate requires Rhode Island residents to maintain minimum essential health care coverage beginning January 1 2020 or pay a tax penalty. January 1 2020.

The states individual mandate took effect in 2020 and the penalty for non-compliance is assessed on state tax returns in Rhode Island starting with the returns filed in early 2021. The penalty will be 25 of household income or 695 per adult and 34750 for each child under the age of 18 whichever amount is higher. The states taxation division released a list of tax changes taking effect Wednesday.

In 2019 96 of Rhode Islanders have health coverage. Rhode Island is one of a handful of states where there is a tax penalty for not having health insurance. The penalty will be 25 of household income or 695 per adult and 34750 for each child under the age of 18 whichever amount is higher.

The reduction of the federal mandate penalty to 0 led Rhode Island to enact a state level mandate. A grandfathered health plan. Health Insurance Mandate Forms to attach to RI-1040 or RI-1040NR if applicable.

Rhode Islands individual health insurance mandate is based in part on the federal mandate estab-. 25 of the taxpayers household income over the state filing threshold or 695 per adult and 347 per child whichever is greater. Failure to have coverage in 2020 may result in a Rhode Island personal income tax penalty during tax-filing season in early 2021.

Rhode Islands penalty is 695 for each uninsured adult and 34750 for each uninsured child or 25 of the household income whichever is greater. Ad You can compare over 600 health policies from over 20 different funds online now. AP Rhode Island residents must now have health insurance or face a penalty on their taxes.

The penalty is the greater of two amountsthe flat dollar amount 695 or the percentage of income amount 25 percent of income.

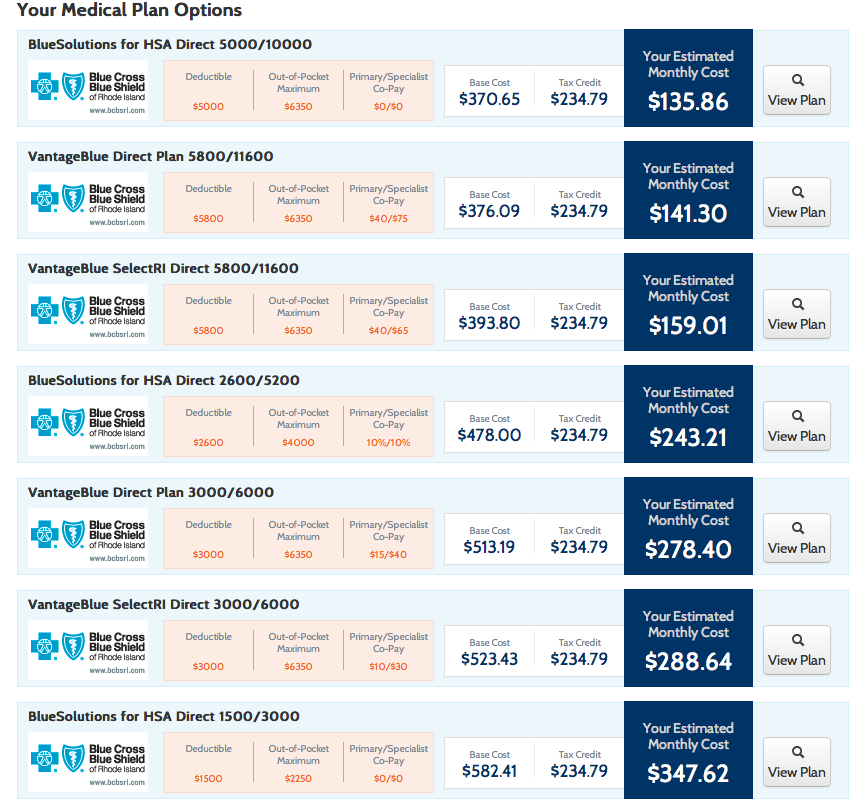

Rhode Island Health Insurance Exchange

Http Www Tax Ri Gov Advisory Adv 2021 06 Pdf

Rhode Island Health Insurance Exchange

Rhode Island Health Insurance Marketplace History And News Of The State S Exchange Healthinsurance Org