Can I Drop My Employer Health Insurance

F you lost your job or your employer dropped your insurance you will qualify for a special enrollment period. Youll get a SEP to enroll when you leave your employer.

Small Business Health Insurance Requirements 2020 Ehealth

See if you can find what youre looking for by comparing policy fees extras more.

Can i drop my employer health insurance. If they are they are de facto enrolled in a Section 125 Plan and cannot change that election until Open Enrollment or a Qualifying Life Event. Or on the other hand maybe you get benefits through a companions boss inclusion. Come to Medicare Part D and or purchase a Medicare subsidy plan.

When you turn 65 you should sign up for Part A coverage whether or not you have employer health insurance since you will likely get this coverage for free. In many cases not only can the employer refuse to allow you to terminate and drop your insurance coverage they must. Depending on the size of the company a company with fewer than 50 employees is not even required to provide coverage under the affordable care act.

You will be able to delay enrollment up until the time that your employer insurance ends. Once you lose your employer health benefits if youre not already enrolled in Medicare you will have a special enrollment period of 8 months to enroll in Part A and Part B. Health insurance can be canceled retroactively but your employer and the insurance provider would have to have a pretty solid case of fraud or misrepresentation against you.

Ad You can compare over 600 health policies from over 20 different funds online now. In the event that you are turning 65 and as yet working you may in any case be secured by your boss medical coverage plan. Can I drop my employer health insurance and go on Medicare.

Please note that the following information also applies if the employer coverage is via your spouse. Federal law limits when an employee may add subtract or change coverage or coverage options. Thus if your employer insurance allows it or qualifies for it you can delay both Medicare and Medigap enrollment without penalty rate increases.

The short answer is yes an employer can notify all its employee to seek individual coverage elsewhere because they are dropping coverage. For instance if you had insurance through your employer but got married and youve been added to your spouses insurance plan and no longer wish to keep your employer-sponsored health plan you can drop your coverage. In most cases older employers do better by keeping their existing company healthcare plans.

See if you can find what youre looking for by comparing policy fees extras more. If you go through this process you may want to consider enrolling in prescription drug coverage below. Rescission of coverage thats what retroactive cancellation is called in the Affordable Care Act is strictly prohibited.

This page describes how Medicare works if you have health coverage as part of your employment benefits. You Can Drop Employer-Sponsored Health Insurance Coverage Just like taking your employers health insurance plan is voluntary so is dropping it. That being said assuming your employer is using an off the shelf plan and are as permissive as what the IRS allows then yes change in coverage under another employers plan is a permissible midyear change event allowing you to decrease or revoke your election if you have elected corresponding coverage under your spouses plan.

To address this inquiry in a simple manner yes you can drop your employer based health care coverage for Medicare. Even though you can drop your employer health insurance for Medicare it may not be your best option. So the answer is yes you may drop your employer health insurance to go on Medicare assuming youre at least 65.

An employee can voluntarily cancel coverage at any time only if the company is not having employee premium contributions deducted pre-tax. For example you may be able to. Consider that keeping your employer insurance plan can mean maintaining the benefits that you and your dependents may need.

You can shop for insurance online through the Marketplace. If your employer is considered a large employer with over 20 employees then yes you can drop Medicare without being penalized. Lower your employers insurance and enroll in Basic Medicare Part A and Part B.

You can cancel your health insurance plan at any time but if you cancel outside of the year-end open enrollment period chances are you wont be able to enroll in a new healthcare plan until the next open enrollment period rolls around in the fall. Additionally enrolling late will not incur a penalty with Medigap plans. If Possible Cancel during Open Enrollment.

Those with more than 50 employees can drop coverage and pay the. The real question is whether you should sign up for Part B coverage if you already have employer health insurance coverage. Ad You can compare over 600 health policies from over 20 different funds online now.

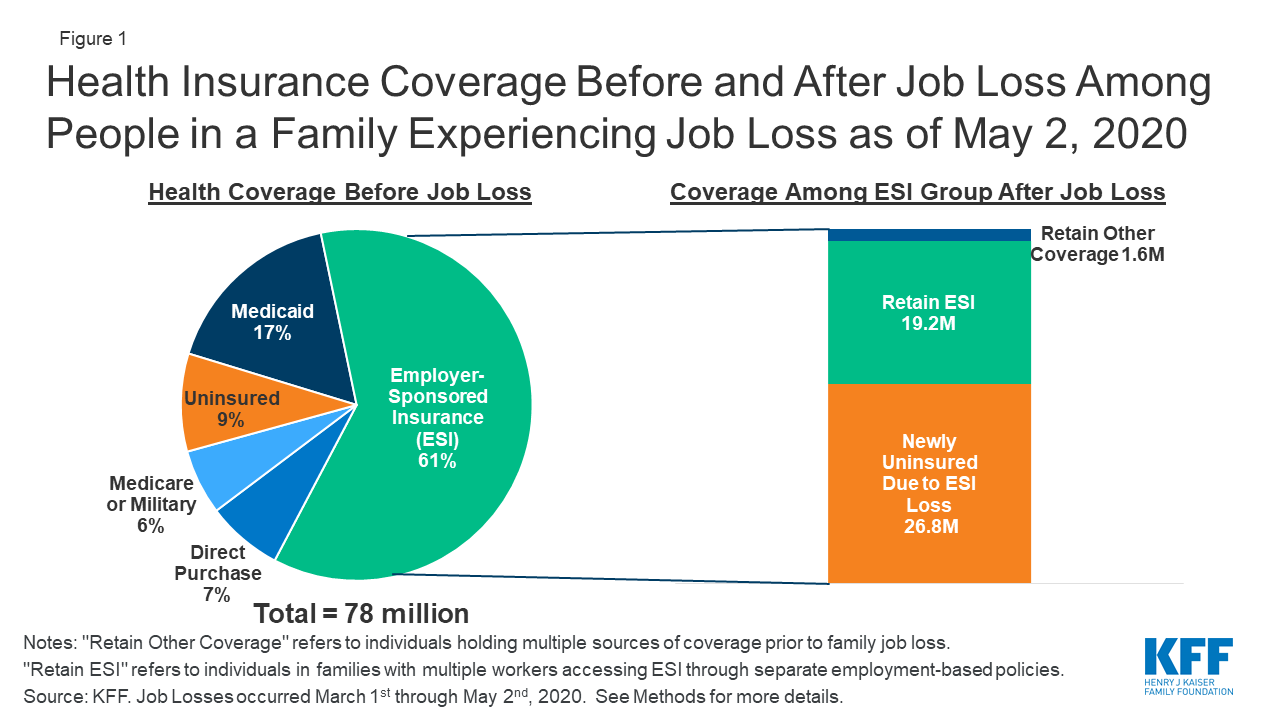

Eligibility For Aca Health Coverage Following Job Loss Kff

How To Escape The Employer Sponsored Health Insurance Trap By Ed Dolan The Startup Medium

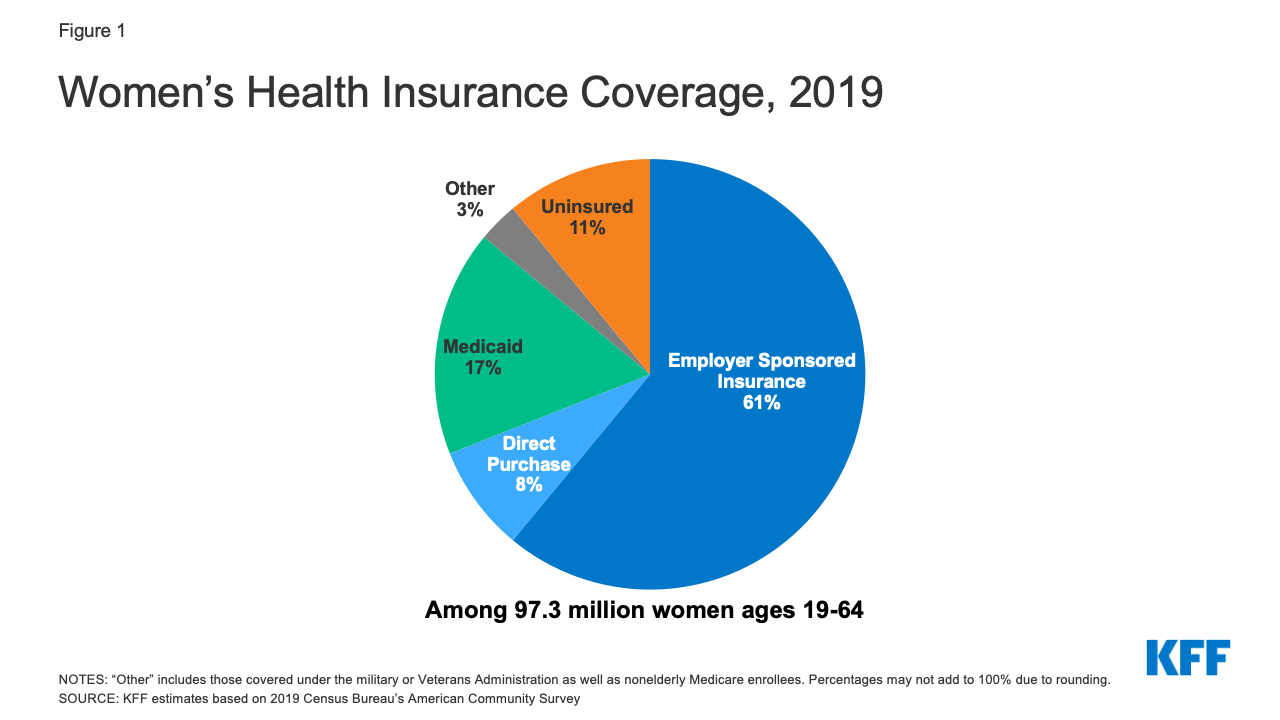

Women S Health Insurance Coverage Kff

Proposals Would Change Employer Role In Health Insurance