Co Op Health Insurance Texas

The monthly fees are called membership fees not premiums. We work with health educators to provide member training about the benefits of getting appropriate and timely care.

How To Get Cheap Health Insurance In 2021 Valuepenguin

Back to Glossary Index.

Co op health insurance texas. The new law provides for the creation of qualified nonprofit health insurance issuers to offer qualified health plans in individual and small group markets Section 1322. Texas Department of Insurance 333 Guadalupe Austin TX 78701 PO. 01744 812 411 Co-op Health - about our pharmacy PDF 1 page 86KB Read Co-op Health terms and conditions.

Mountain Health CO-OP seeks to improve safety by providing information to physicians and members to help them make better decisions about medications and medical care options. To put that into perspective regular COBRA insurance premiums can cost as much as 650 per month. 45 indicate that their plan covers to a degree everything they want.

South Texas Health Cooperative hereafter referred to as Co-op hereby amends and restates the South Texas Health Cooperative Employee Medical Benefit Plan a self-funded Employee Welfare Benefit Plan hereafter referred to as the Plan The Plan benefits and administration expenses are paid directly. We encourage you and your family to become familiar with this website. Box 12030 Austin TX 78711 512-676-6000 800-578-4677.

62 of those who do not have health insurance cite high cost as the reason. The ACA permits qualified nonprofit health insurance issuers participating in the CO-OP program to enter into collective purchasing arrangements for services and items that increase administrative and other cost efficiencies especially to facilitate start-up of the entities including claims administration general administrative services health information technology and. CO-OP now stands for Consumer Operated and Oriented Plan.

Cooperatives can be formed at a national state or local level and can include doctors hospitals and businesses as member-owners. The average cost of a membership fees run about 40 to 90. Cooperatives can be formed at a national state or local level and can include doctors hospitals and businesses as member-owners.

A non-profit entity in which the same people who own the company are insured by the company. Our plans are accepted by providers across the state. Back to Glossary Index.

This price varies based on a number of factors including employee age and gender. Top sources of primary health insurance for members. A non-profit organization in which the same people who own the company are insured by the company.

To make our coverage even more affordable you may also qualify for cost share reductions from the federal government that could reduce your costs significantly. Texas Health Information Counseling and Advocacy Program A resource for Medicare beneficiaries and their caregivers. Texas law allows two or more employers to form a non-profit private.

Welcome to Your Employee Benefits Portal. 86 of REALTORS have health insurance. CO-OPs are private nonprofit state-licensed health insurance carriers.

Cooperatives are groups of large or small employers or in some cases a combination of both that join together to obtain health coverage for the cooperative as a single entity. Their plans can be sold both inside and outside the health insurance exchanges depending on the state and can offer individual small group and large group plans. Texas Department of Insurance Oversees regulates and licenses the health insurance companies that provide coverage in the state as well as the agents and brokers who sell the policies.

This plan was the cheapest in 43 of Texass counties. 53 pay the entire premium of their coverage. The larger the cooperative the more clout it has to negotiate favorable prices and coverage.

To find the plan thats right. Health insurance co-ops have been given a new name to go with the co-op acronym. The average cost of health insurance in Texas for a 40-year-old is 509 per month which is a 4 increase over last year.

Health insurance co-ops are significantly cheaper than regular health insurance. The Ambetter Balanced Care 29 2021 plan was often the cheapest Silver health insurance available in the state. Funded initially by 6 billion in the Affordable Care Act the CO-OP effort already had been cut to 34 billion even before the fiscal cliff deal swept most of.

Mountain Health CO-OP offers affordable health insurance for individuals and families as well as businesses. Inside you will find detailed information about your employee benefits program including benefit summaries claim forms administrative forms customer service numbers provider directories and direct links to the insurance carriers. Business owners in Texas can expect to pay at least 163 per employee for small business health insurance coverage.

Co-ops will offer insurance through the Marketplace. Can answer questions about a wide range of Medicare issues.

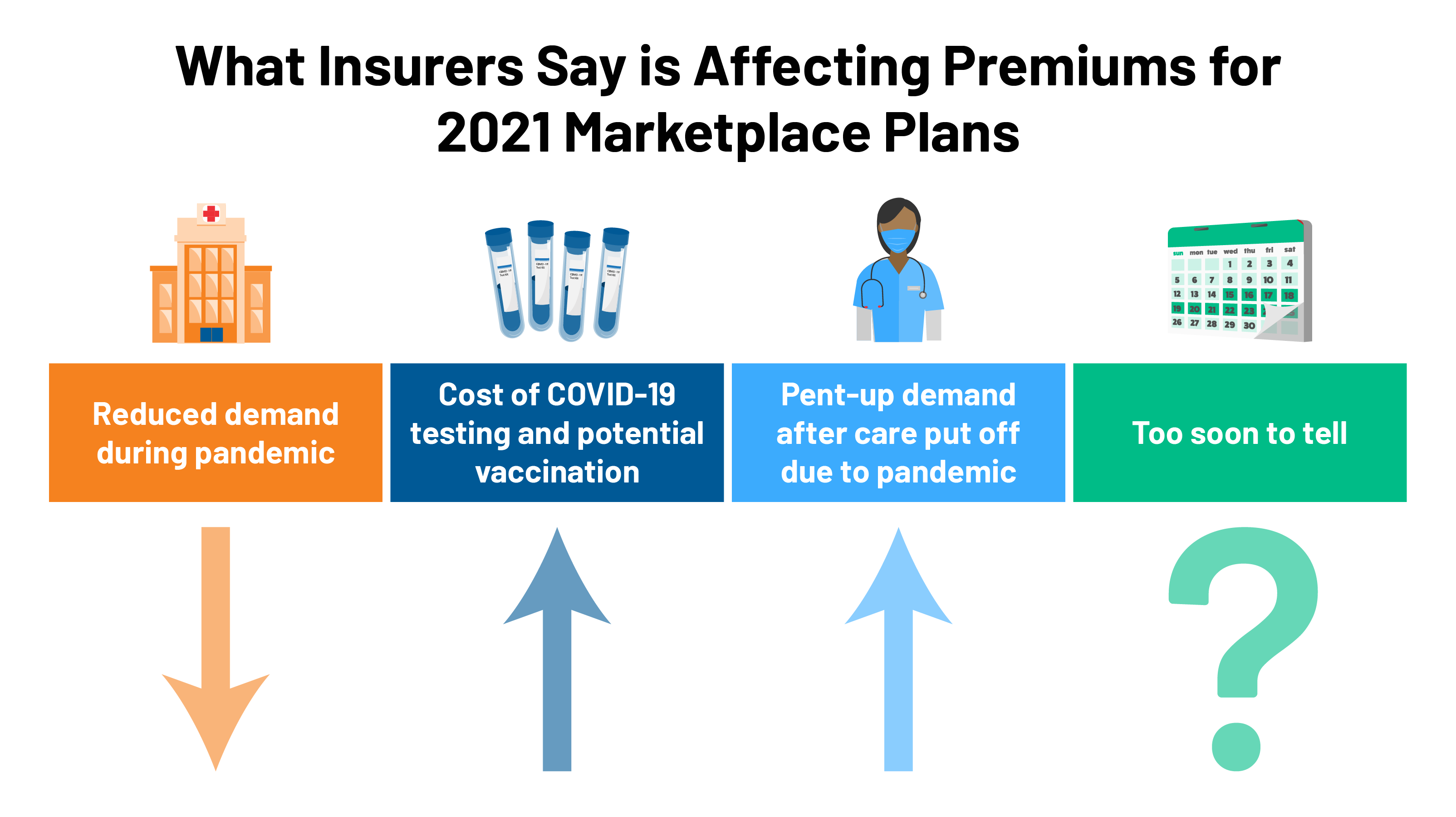

2021 Premium Changes On Aca Exchanges And The Impact Of Covid 19 On Rates Kff

Co Op Health Plans Patients Interests First Healthinsurance Org

Best Cheap Health Insurance Texas 2021 Valuepenguin

Texas Small Business Health Insurance Group Medical Plans Ehealth