S Corp Officer Health Insurance

Health and accident insurance premiums paid on behalf of a greater than 2-percent S corporation shareholder-employee are deductible by the S corporation and reportable as wages on the shareholder-employees Form W-2. The amount increases the officers Federal.

A Beginner S Guide To S Corp Health Insurance The Blueprint

If you form a regular C corporation your corporation can provide you with health insurance as an employee fringe benefit and deduct the cost as a business expense.

S corp officer health insurance. Once you run payroll you will have the option to enter the S-Corp amount. One drawback to the S corporation is that employeeowners cannot deduct the cost of health insurance from taxes. Since your portion of S.

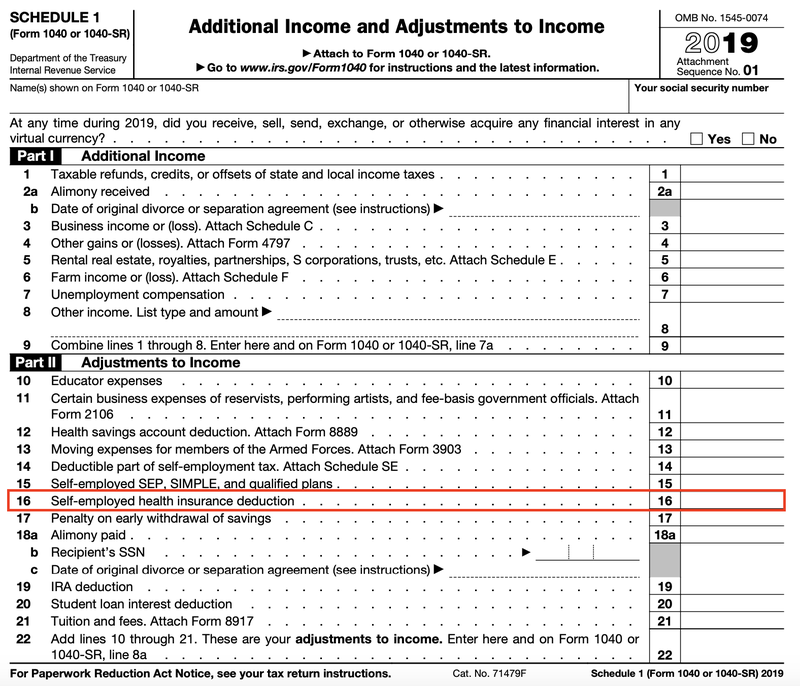

S-Corp to include the health insurance premiums on Form 1120S Line 7 Officer compensation. Typically what I do in this situation is report the shareholder health insurance as a distribution or as a non-deductible on the S. Specifically the shareholder can now deduct the insurance premiums as an above the line deduction on Line 29 of Form 1040.

You can add the Recurring amount or leave it blank. To learn more about S-Corp Owners Health Insurance check this article. Select Done see screenshot below.

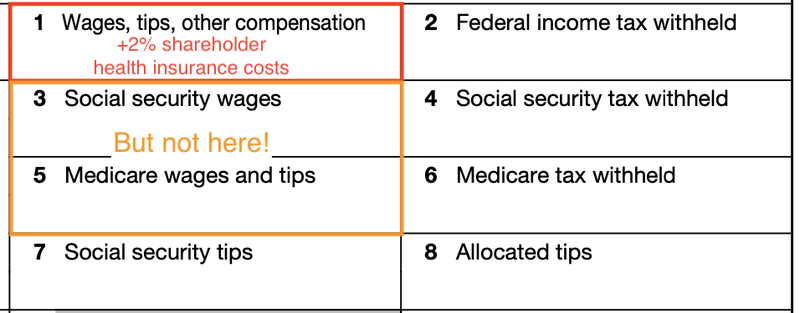

The cost of any health dental vision supplementalAFLAC long-term care premiums and often HSA contributions paid by the s-corporation on behalf of a shareholder are deductible so as long as the company has fulfilled the requirement to report amounts on the officers W2. Shareholder health insurance for a more than 2 owner is to be reported on their W-2 and if possible the shareholder would make an adjustment on the front of their 1040 return. Health insurance premiums paid by an S Corp for more than 2 shareholders must be treated as wages to that owner.

Say you own 25 of an S corp which earned 50000 last year. Health Insurance Employee Benefit for a S Corporation. Wages 50000 health insurance 15000.

These premiums do not have to be itemized on your Schedule A and you can take it as a deduction in addition to the standardized deduction if you do not have any other expenses to itemize. Treating Medical Insurance Premiums as Wages. Medical Insurance Premiums As Wages.

While an S corp has pass through taxation like many other forms of tax elections in respect to health insurance premiums the law gets more complex. S-Corp Medical health premiums increase taxable wages and tax deductions. In other words the only way an S Corp can deduct the amount paid for shareholder health insurance is to include it as part as part of the shareholders salary.

In other words the premiums are included in the shareholderemployees salary and reported on the individuals W-2 form. The insurance is treated as supplemental wages for withholding purposes. For those who file a Schedule C such as with an s corporation you will need to put the cost of your health insurance on line 29 of your personal 1040 tax return.

Where does health insurance for an officer of an s corp go on 1120s and K-1. If your corporate officers elect to apply the health insurance to their wage base at the end of the calendar year even though the company has been making premium payments throughout the year in QuickBooks you can use paycheck to report the amount of S-Corp Medical benefits that you have paid for the year to. Maximize Even more ways to pay employee then select S-Corp Owners Insurance.

The S corporation receives a deduction for health insurance of greater-than-2 shareholders as compensationwages on Line 8 or 9 of Form 1120S depending on whether the shareholder is an officer. Less than 2 shareholder health insurance is included with the expense for other employees as a deduction by the entity. Health Insurance Not a Tax-Free Fringe Benefit for S Corporation Shareholders Ordinarily when you form a corporation to own and operate your business youll work as its employee.

Go to Screen 15 Ordinary Deductions. An S corporation deducts the premiums it pays for accident and health insurance to cover a 2 shareholderemployee and his spouse and dependents as compensation paid to the shareholderemployee. Line 7 should show 50000 line 18 should show 15000.

S-Corp to include the health insurance premiums in the 2 shareholder-employees W-2 Box 1 wages but not Box 3 SS wages and Box 5 Medicare wages. The owners health insurance can no longer be called an insurance expense or employee benefit expense on the 1120S. You and your familys medical health insurance premiums totaled 15000 last year.

S corps have complicated issues with health insurance premiums paid for their. 2 shareholder-employee to claim the self-employed health insurance deduction. The corporate reimbursement requirement is important so even if you have to journal in the reimbursement when doing the S Corp return it is important to show it within the S corp.

Enterinclude the amount in Salaries and wages. Set up S-Corp Owners Health Insurance. Page 16 of the Instructions for Form 1120S states.

To enter the Officer health insurance on Form 1120S line 8 for Officers owning more than 2 of the corporationss stock. Nevertheless the S corporation owner will qualify for a tax-favored self-employed health insurance deduction on their personal tax return by including the health insurance premiums paid by the corporation as taxable wages.

A Beginner S Guide To S Corp Health Insurance The Blueprint

A Beginner S Guide To S Corp Health Insurance The Blueprint

S Corporation Reminder Before You Finalize Your Year End Payroll Don T Forget To Include Shareholder Medical Insurance Premiums In W 2 Wages Wegner Cpas

Https Support Businessasap Com Article 261 S Corporation Officer Health Insurance